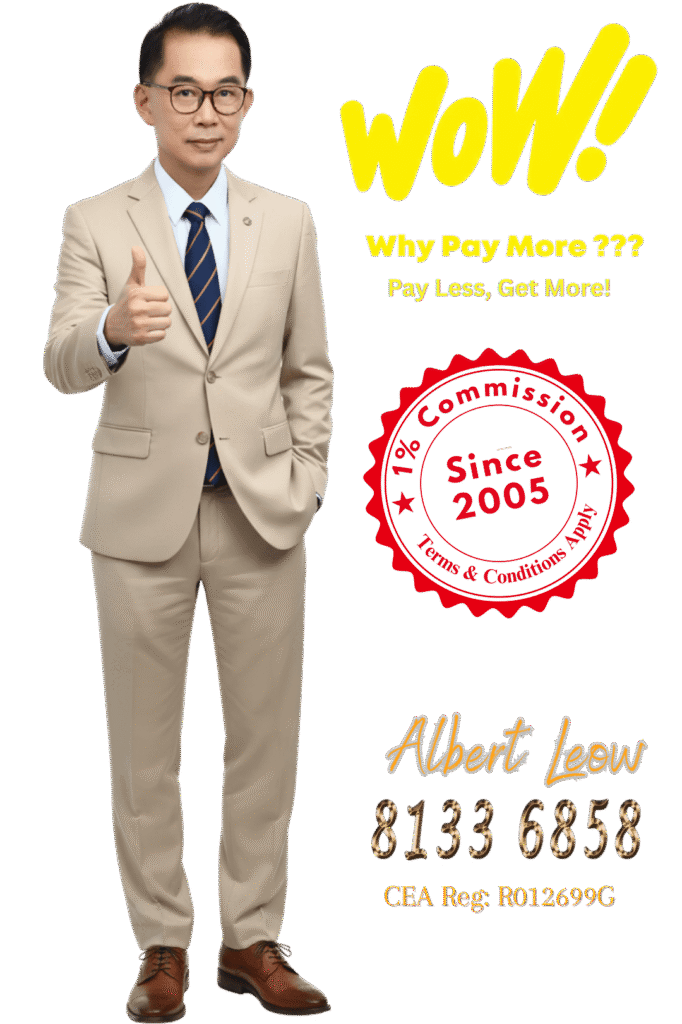

⭐ Why Pay More? Sell at Just 1% with Albert Leow – Pay Less, Get More! ⭐

⭐ Why Pay More? Sell at Just 1% with Albert Leow – Pay Less, Get More! ⭐

Save 50% in agent fees while still getting full premium service.

Building Assets, Elevating Value !

Hello, Valued Clients! 🌟

Albert Leow, licensed property agent with Huttons Asia Pte Ltd and NUS graduate, brings solid experience from past roles in shipping and construction.

With 30 years’ expertise, he focuses on landed redevelopment, CBD office leasing, and sales/rentals of condos, apartments, commercial, and industrial properties.

Albert provides market insights, precise execution, and tailored advice to safeguard your interests in every transaction.

Why Choose Me?

More Value. Lower Cost. Maximum Results.

Market Standard | With Albert Leow |

2% commission (typical agents) | 1% commission only – save instantly |

Basic marketing reach | Premium exposure on PropertyGuru, 99.co, , Facebook, Instagram & TikTok Ads |

Generic service | Tailored strategy designed for your property |

Average negotiation | Proven skills to secure the highest price possible |

Marketing Strategy Focusing on precision targeting through: ✓Facebook, Instagram, and TikTok Ads (targeted lead generation) ✓PropertyGuru, 99.co, SRX listings. ✓Google Ads (Property value > $10m) Retargeting to reach ready buyers | |

Viewings & Compliance: Yes, I personally conduct all viewings to ensure accurate representation and compliance with CEA guidelines. This also allows me to manage buyer feedback and negotiations directly for your best interest. |

Why Pay More? Pay Less — and Get More.

Trusted Partner in Property Sales

What My Clients Say

What is SSD (Seller’s Stamp Duty)?

- SSD is a duty imposed on sellers/transferors of property when the property is sold (or disposed) within a specified “holding period” after the acquisition.

- SSD is designed as a cooling / anti-speculation measure, to discourage very short-term flipping of property.

- SSD is calculated on the higher of (i) the selling price (consideration) or (ii) the market value (if higher) of the property or portion thereof.

- SSD only applies to certain classes of property (residential and industrial), not all property types.

SSD Summary & Comparison

Property Type / Scenario | SSD Applies? | Holding Period / Rates | Key Notes / Exceptions |

Private Residential (condo, landed) | √ if sold within SSD period | For acquisitions ≥ 4 July 2025: up to 1 yr = 16%, 1–2 = 12%, 2–3 = 8%, 3–4 = 4%, >4 yrs = 0% | For acquisitions before that date, refer to old regime. |

HDB flats | Generally X in practice (due to MOP) | SSD might apply in rare cases if sold before MOP / under special approval | Default exemption via regulation; not many HDB cases with SSD. |

Commercial properties (office, retail, etc) | X | N/A | SSD does not apply generally. Portion-based if mixed use.. BSD applies to buyers. |

Industrial properties | √ | Portion-based if mixed use. | |

Mixed-use (residential + commercial) | √ (residential portion) | SSD on residential portion per residential rate | Determine permitted use, apportion accordingly. |

How do I calculate the holding period for Seller's Stamp Duty (SSD)?

Date of Property Purchase/Acquisition | Minimum Holding Period |

Between 14 Jan 2011 and 10 Mar 2017 (all inclusive) | 4 Years |

Between 11 Mar 2017 and 3 Jul 2025 (all inclusive) | 3 years |

On and after 4 Jul 2025 | 4 Years |

Please refer to the IRAS website for more information on calculating the holding period for SSD under different circumstances.

The date of purchase or acquisition

If a residential property is acquired on or after 20 Feb 2010, SSD is payable if the residential property is disposed of within the holding period.

In most instances, the date of purchase/ acquisition of a property refers to:

- Date of Acceptance of the Option to Purchase* or

- Date of Sale and Purchase Agreement or

- Date of Agreement for Lease (for new HDB flat) or

- Date of transfer to a beneficiary where the property was originally held on trust for non-identifiable beneficial owner(s) or

- Date of Transfer where the above (a), (b), (c) and (d) are not applicable

*Excludes an Option to Purchase that is subject to the execution/ signing of the Sale and Purchase Agreement

FAQ

1. Does 1% commission mean less service?

Not at all. You’ll still receive full premium service — professional marketing, targeted ads, property portals, buyer network, and strong negotiation. The only difference is you save more on fees.

2. How do you market my property?

I use a multi-channel approach: PropertyGuru, 99.co, Facebook, Instagram, Google Ads, and my buyer database. This ensures maximum exposure and genuine buyers in the shortest time.

3. Why choose Albert over other agents?

With my construction background and 30 years of experience, I offer insights beyond sales — from property positioning to redevelopment advice. Plus, you save 50% in fees compared to the typical 2% agents charge.

4. Are there any hidden costs?

No hidden costs. My commission is transparent at 1%. Photography, marketing, and professional support are included — you pay less, but still enjoy full service.

5.Do you charge GST?

Yes, Huttons Asia is a GST-registered company. Commission rates quoted are not inclusive of prevailing GST rate.

6. What’s the first step to get started?

Simply fill in the form or contact me via WhatsApp. I’ll provide a free consultation, understand your property goals, and propose the best selling strategy for you.

Tell Us About Your Property – Free Consultation

By submitting, I accept the privacy policy and I consent to the collection of my above personal data and agree to be contacted via phone/email by Albert Leow – Huttons Asia Pte. Ltd..

📍 3 Bishan Place #05-01, CPF Bishan Building, Singapore 579838

👤 Albert Leow | CEA Reg. No. R012699G

📧 Email: sgoutlook@gmail.com